Posted by Jillian Hodgin on Jul 7th 2025

The Big Beautiful Bill and what it means for suppressors!

The Big Beautiful Bill and what it means for suppressors!

As of July 4th, 2025, the Big Beautiful Bill was signed into law by President Donald Trump. While this bill is over 900 pages and has various facets to it, one will affect how we go about the sale of suppressors, short-barreled rifles, short-barreled suppressors, and more!

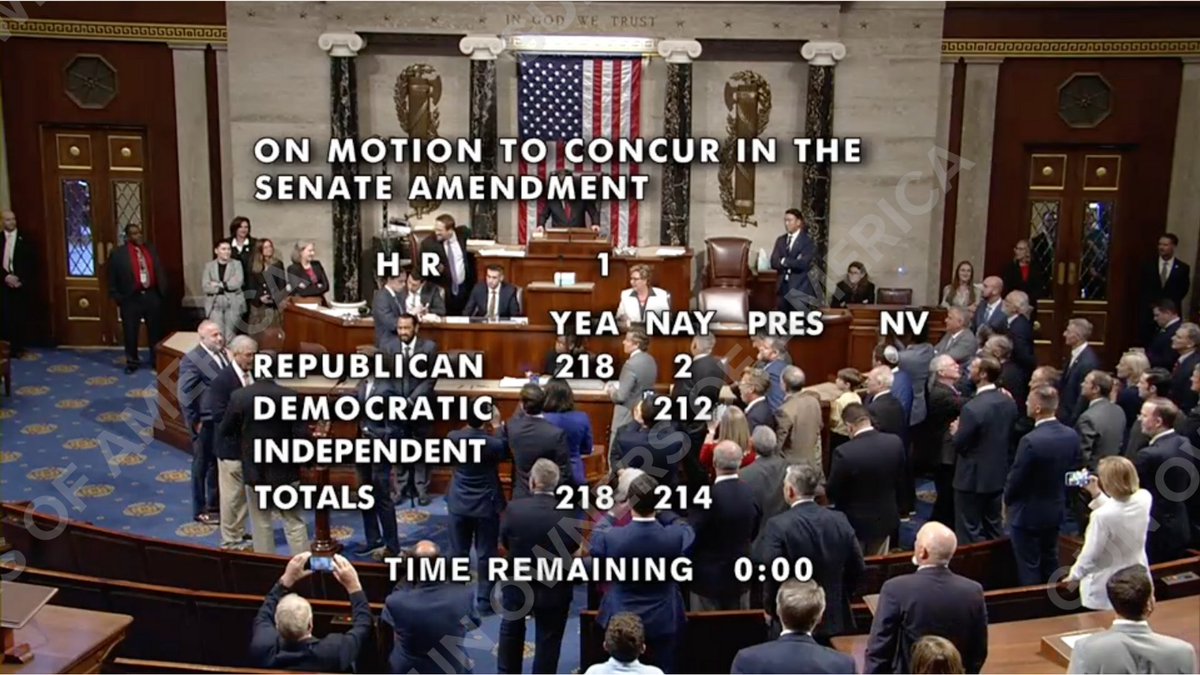

This portion of the BBB was brought up as H.R.1, It started out with removing suppressors from the NFA, no tax stamp, no approval process (besides a regular background check), no fingerprints, but has since undergone several changes. For simplicity's sake, we will just be talking about the supressor/ SBR side of the bill and not the land provision issue or other early drafts of the bill. The House originally passed the amended reconciliation bill, which included H.R.1, 215-214. From the House it moved to the Senate, where they added the Short Act Provision, which would also deregulate SBR’s (Short-barrel rifles), SBS’s (Short-barrel suppressors), and AOW’s (Any other Weapons). Unfortunately, after the Senate added the Short Act Provision, some anti-gun officials were not thrilled with it, and the Senate Parliamentarian (an unelected

official...) removed this provision since it didnt directly affect federal spending or revenue (make that make sense). Luckily, some officials had a fallback option, which was replacing deregulation or removal from the NFA with a $0 tax stamp, which was ultimately passed and put into law.

Since the compromise for this bill to move forward was removing the $200 tax stamp, what does that mean for everyone? First of all, just because the BBB was signed into law on July 4th, 2025, doesnt mean everything in it immediately goes into effect. The $200 tax stamp will not be removed until January 1st, 2026. After January 1st, you will still be required to go through the same process as before, but without the added cost of $200, meaning you still have to fill out a form 4, submit finger prints, a photo of yourself, and more.

Isn't that a federal firearm registry (Some of you with FOPA knowledge may ask)? Why, yes, it could be considered a federal Firearms registry! The Firearm Owners Protection Act of 1986 makes it illegal for the federal or state government to keep a database or registry of firearms you own. Of course, there are exceptions written into this bill, but we aren't talking about those today. A few years after the NFA was enacted, it was challenged as being unconstitutional and creating a registry of firearms. It was proved to be constitutional because the NFA was not creating a list of firearms but rather a list of those who had paid taxes. Since the $200 tax stamp is set to be removed and no one would be paying taxes on their suppressors, SBR’s, SBS’s, and AOW’s I would venture to say that could be considered a registry.

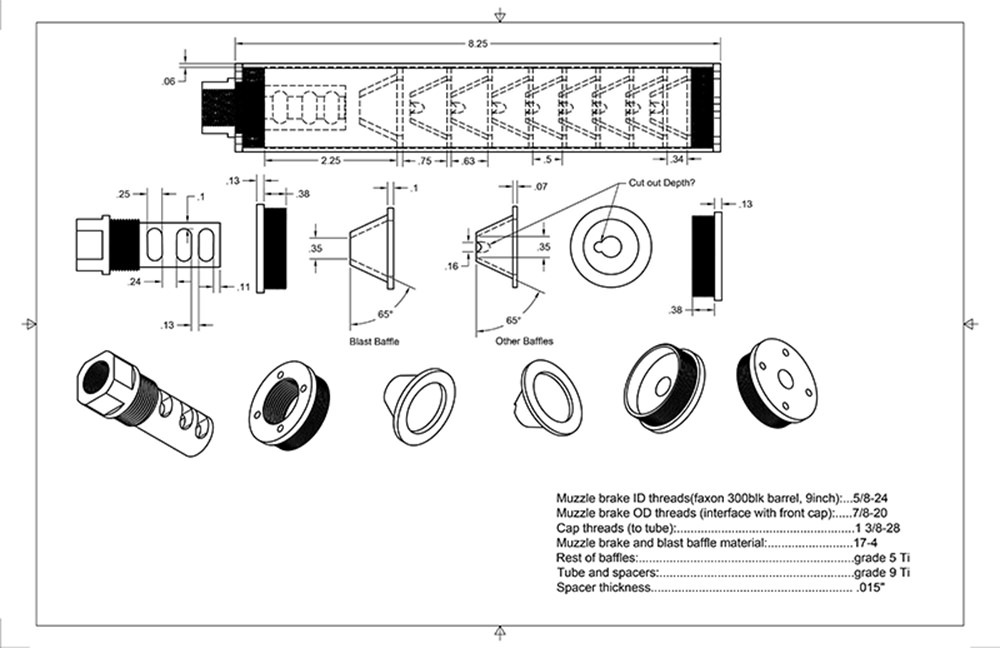

While that does open a nice loophole to consider moving forward and eventually getting supressors, SBR’s, SBS’s, and AOW’s removed from the NFA, this will most likely take a couple of years if it can happen at all. For now, I think most 2A enthusiasts with take what they can get and appreciate having an extra $200 to spend on ammo and accessories or perhaps get a nicer supressor! I certainly hope manufacturers will be building up stock on all of our favorite models because I definitely see a supply and demand shift happening shortly!

Thank you for reading our newest blog post! Have any questions about this topic? Send us a message! Want to watch Jill explain it on video? Check out our YouTube channel @OneForceWeaponry!